Financial Statements

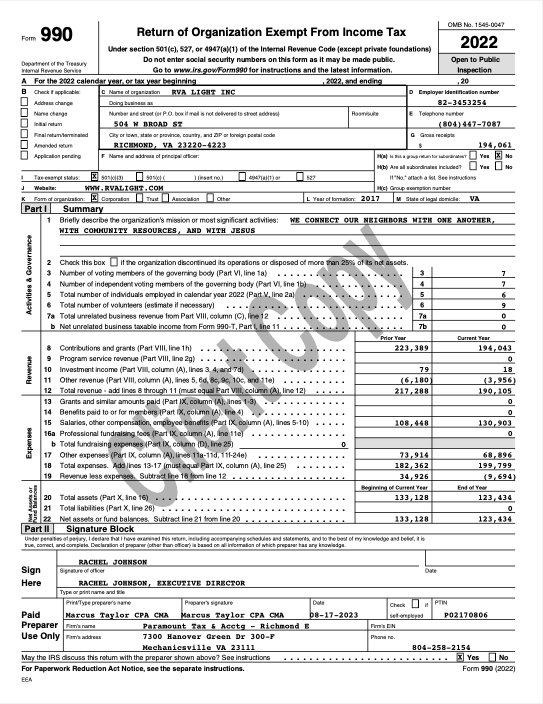

2022 Form 990

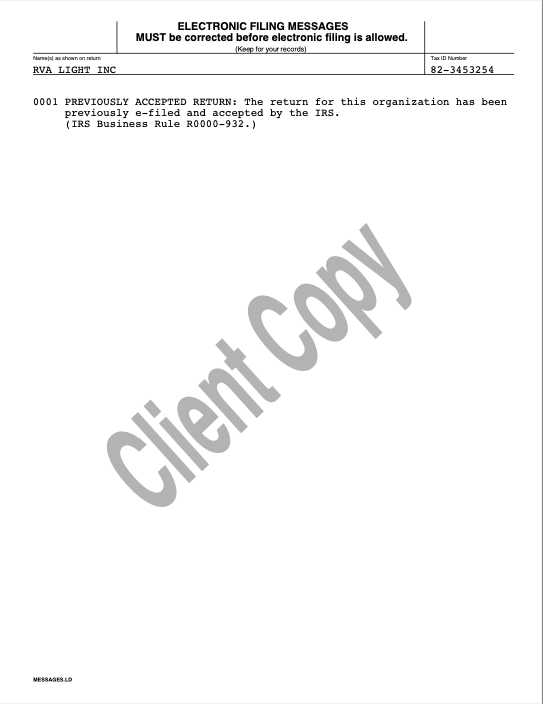

Electronic filing form titled "EF Transmission Status" for tax year 2022, showing transmission details for IRS forms such as 990, 990-T, and others, with a "Client Copy" watermark.

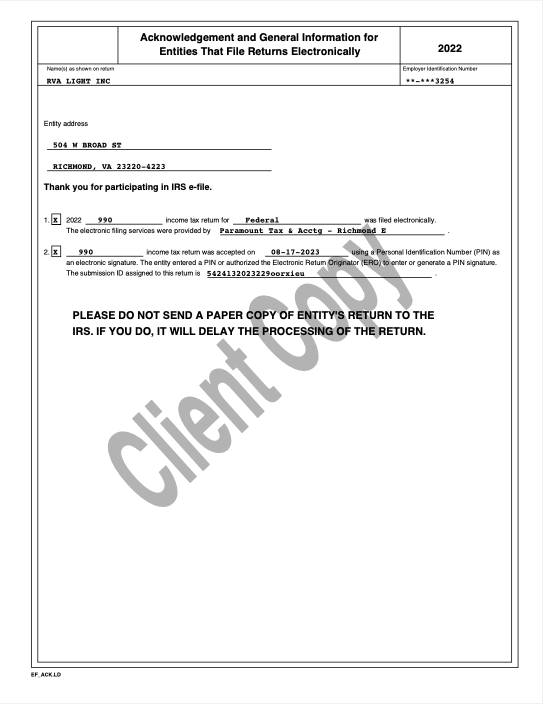

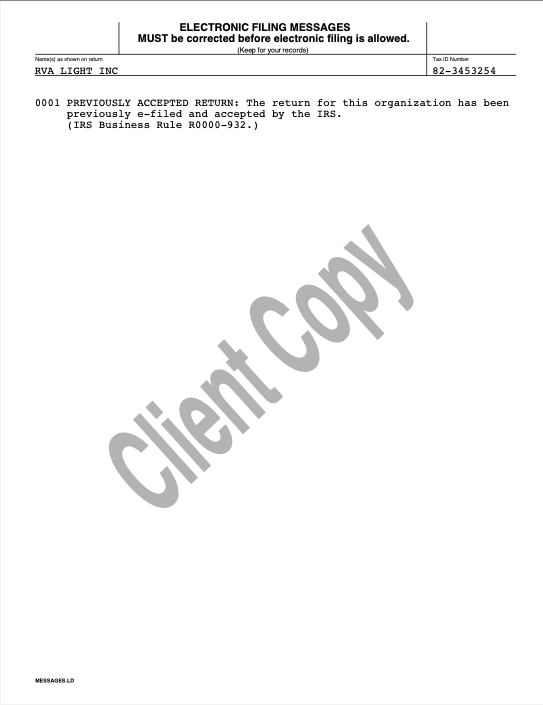

IRS acknowledgment form for electronic tax return filing, showing entity address, filing year 2022, form 990, acceptance date 08-17-2023, electronic signature, and warning not to send a paper copy to IRS. "Client Copy" watermark.

IRS Form 990 for organization, 2022, showing financial information and governance details, including contributions, program revenue, expenses, and assets. Contains preparer and officer signatures.

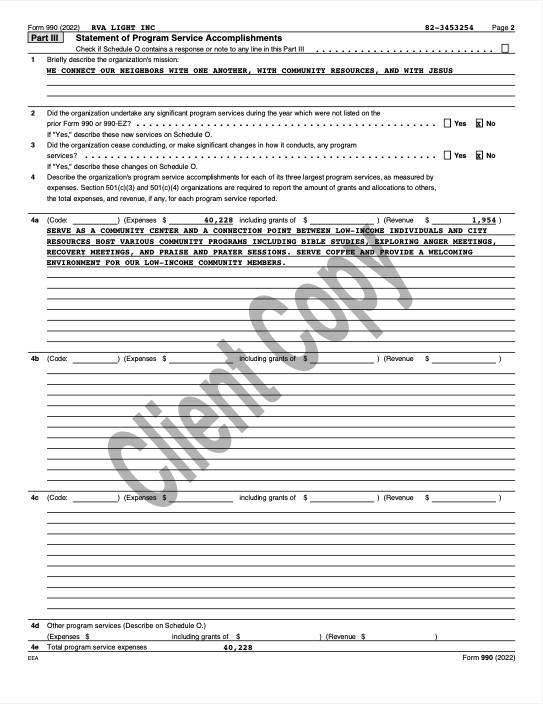

Form 990 (2022) page 2 from Eva Light Inc, focusing on program accomplishments. The mission is connecting neighbors with resources and Jesus. It details programs like Bible studies, anger meetings, and providing coffee and a welcoming environment for low-income community members. Expenses listed are $40,228 and revenue is $1,954. Emphasized as 'Client Copy.'"

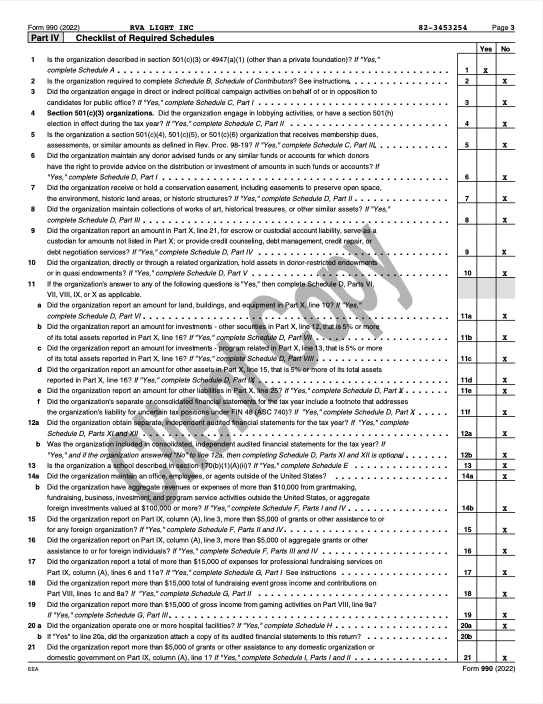

Page 3 of a Form 990 for RVA Light Inc., showing a checklist of required schedules with "Yes" and "No" columns marked.

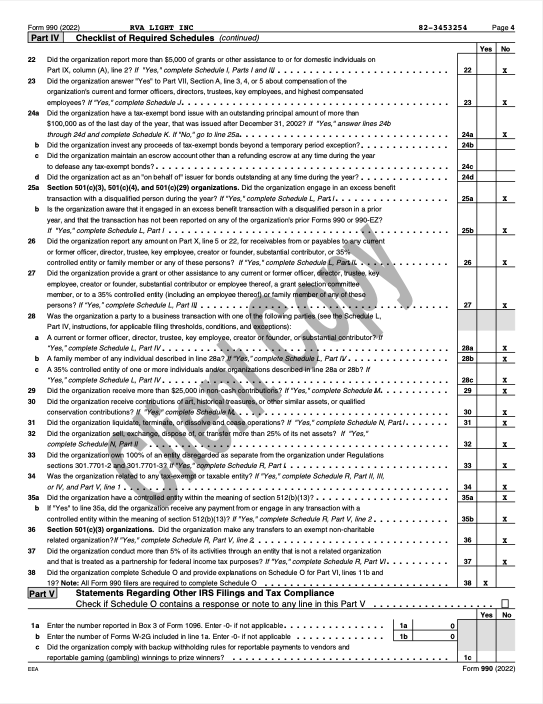

IRS Form 990, page 4, Part IV, Checklist of Required Schedules, showing questions and checkboxes for "Yes" or "No" responses.

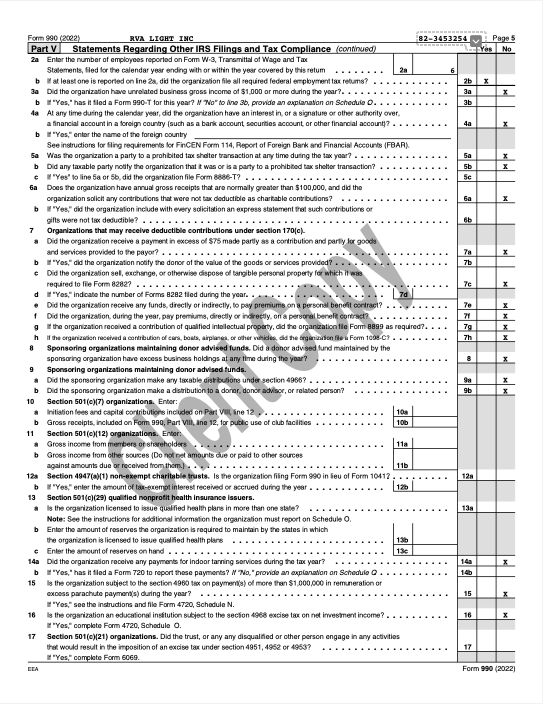

IRS Form 990, 2022 Part V, showing tax compliance questions and responses for a nonprofit organization.

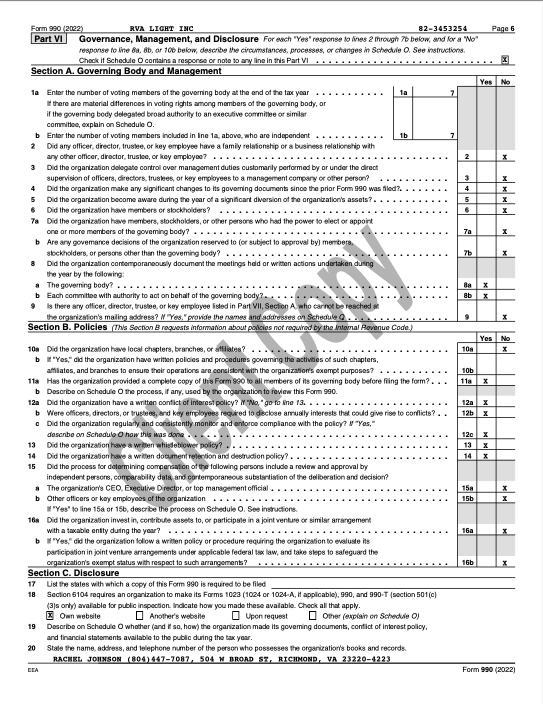

IRS Form 990 page detailing governance, management, and disclosure information for an organization. It includes sections on governing body and management, policies, and disclosure of business practices. Specific questions are listed with checkboxes for answers and spaces for additional details, including the name and contact of the preparer.

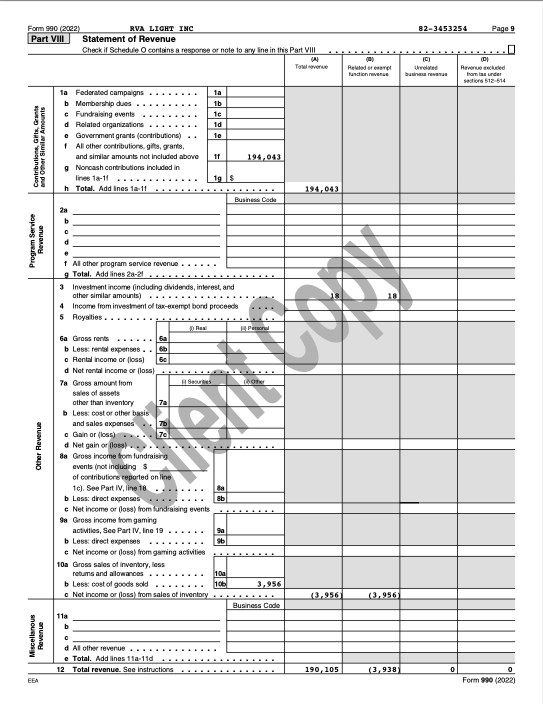

Form 990, Part VIII, Statement of Revenue for RVA Light Inc, showing various revenue sources with tax-exempt status and amounts, including contributions, grants, and other income for tax year 2022, labeled as 'Do Not File, Non-Production Copy.'

IRS Form 990 page showing Part IX, Statement of Functional Expenses for RVA Light Inc, with itemized expenses such as grants, compensation, salaries, and other costs for 2022.

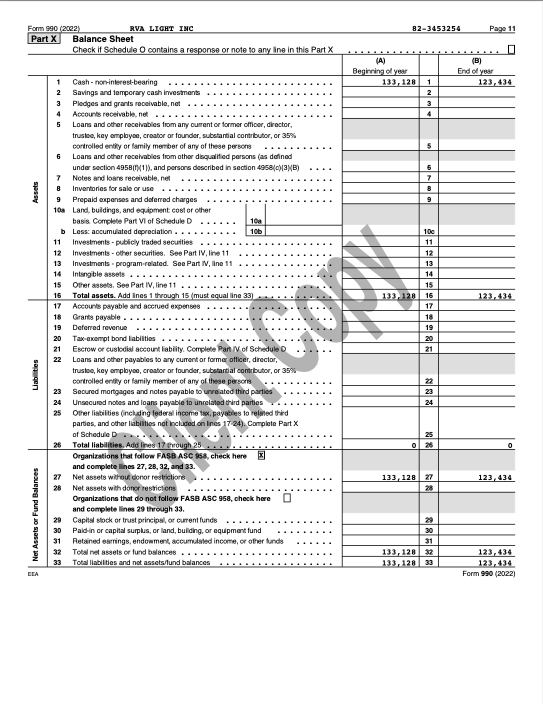

Form 990 balance sheet for RVA Light Inc., showing assets, liabilities, and net assets for the year 2022. Includes figures for beginning and end of year.

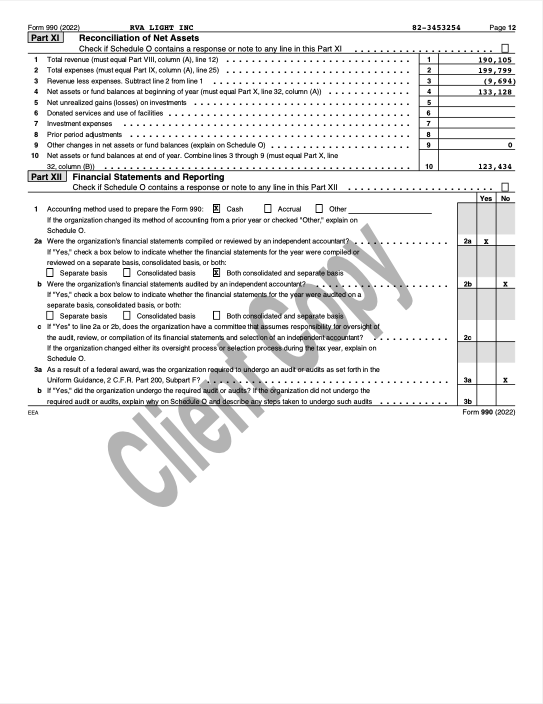

IRS Form 990 page with sections on reconciliation of net assets and financial statements reporting, including checkboxes and numerical fields, marked "Confidential."

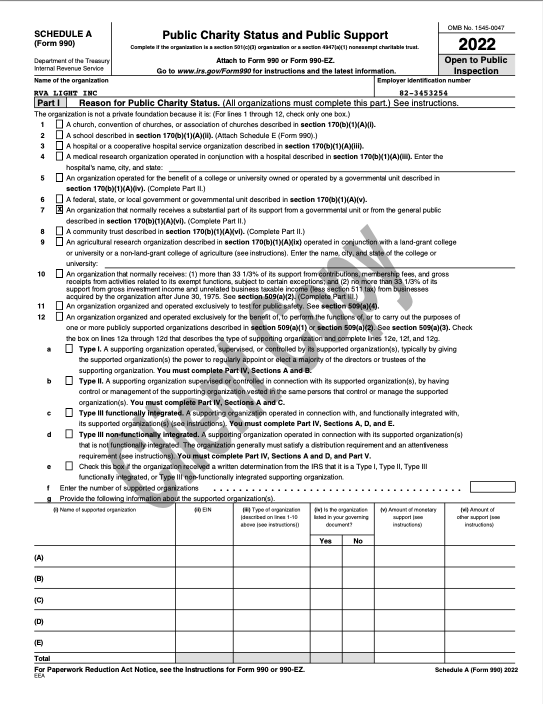

IRS Form 990 Schedule A, 2022 version for public charity status and public support, with data fields and checkboxes for information on organizational status and types, part I shown.

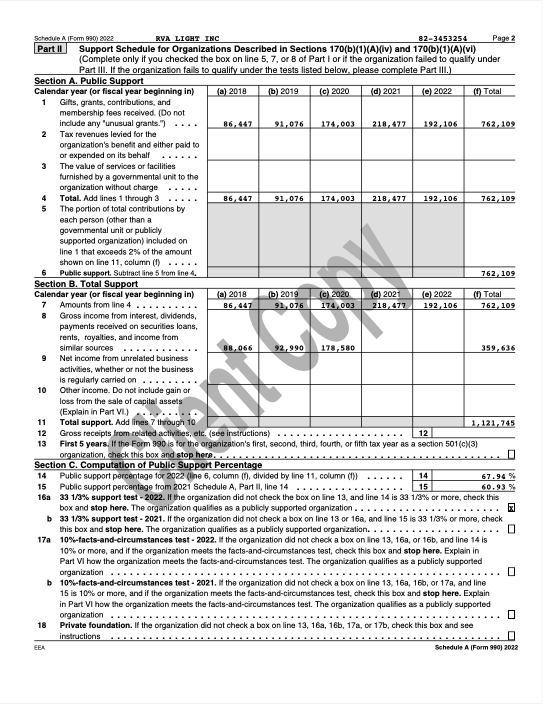

IRS Form 990 Schedule A, Part II, Public Support schedule for 2018-2022. Contains financial data for an organization, detailing public gifts, grants, contributions, revenues, and total support. Includes calculations for public support percentage and related instructions.

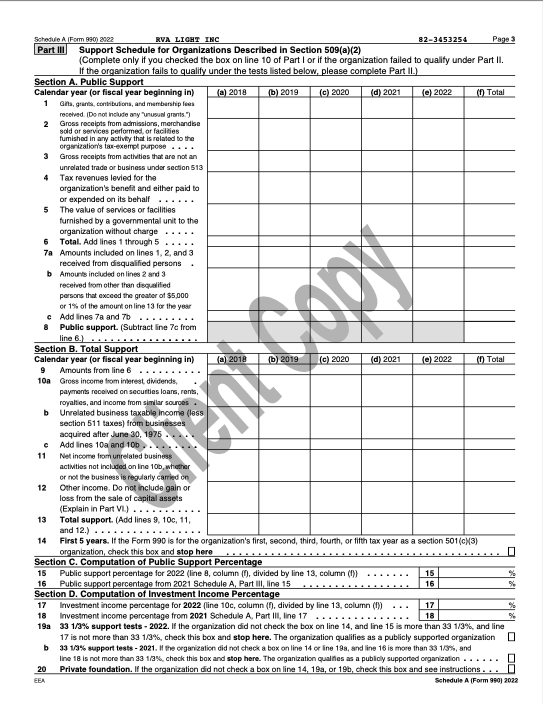

IRS Form 990, Schedule A, Page 3, Public Support, Sections A and B

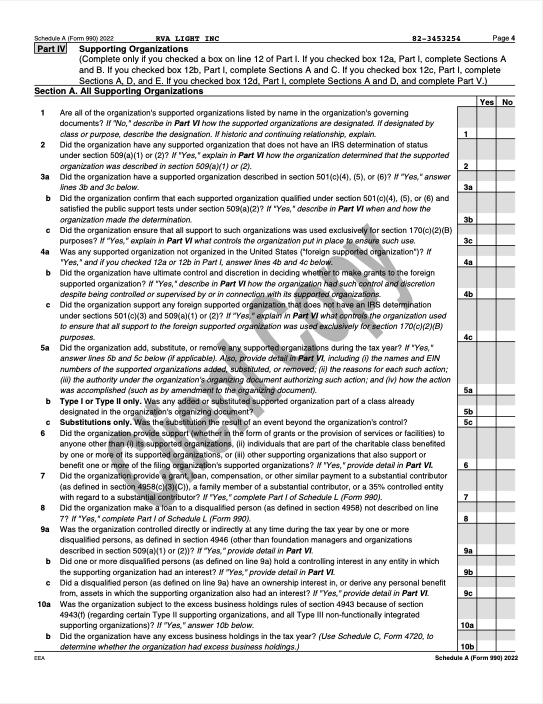

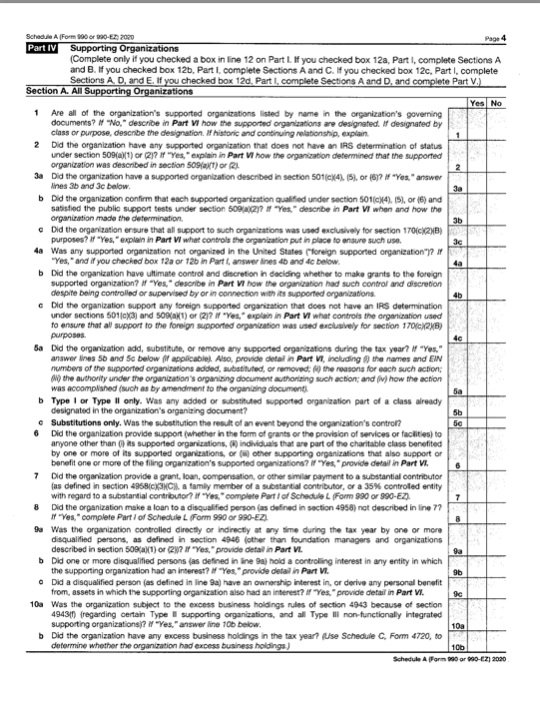

IRS form Schedule A (Form 990) page with questions related to supporting organizations, including sections on organizational governance, IRS determination on support status, and compliance with specific tax-exempt regulations.

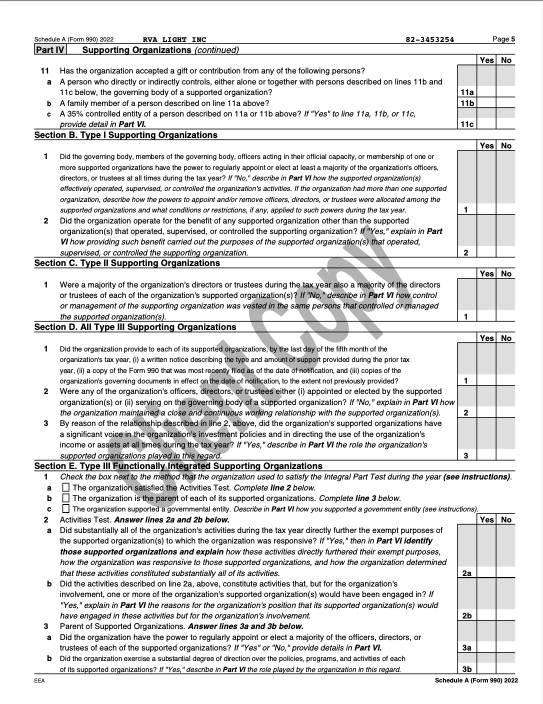

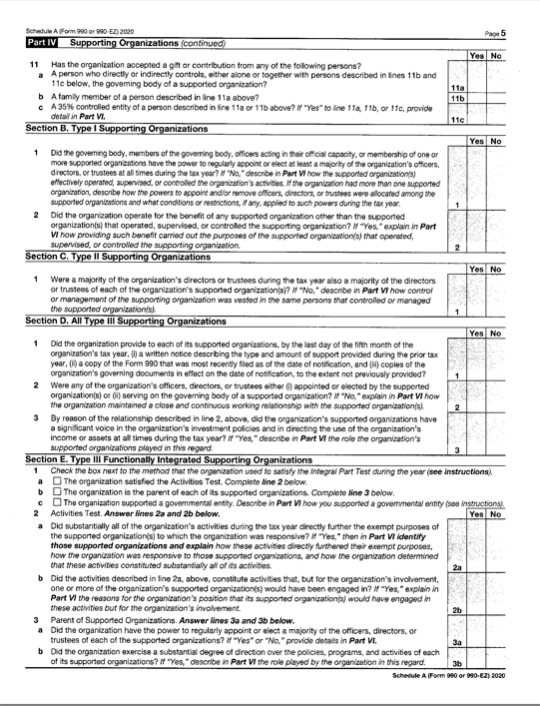

IRS Form 990 Schedule A, page 5 for 2022, containing questions about supporting organizations and their governance, contributions, and operations. Includes multiple sections labeled Part VI, Section B, C, D, and E, with specific questions requiring yes or no answers, and areas for detailed explanations.

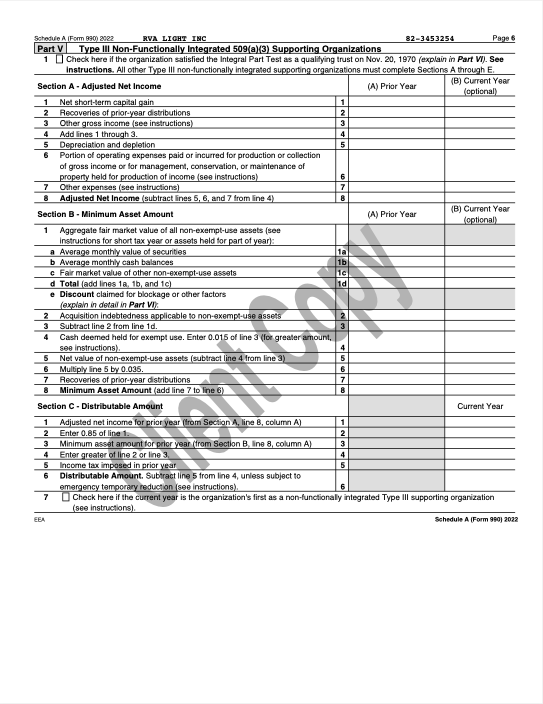

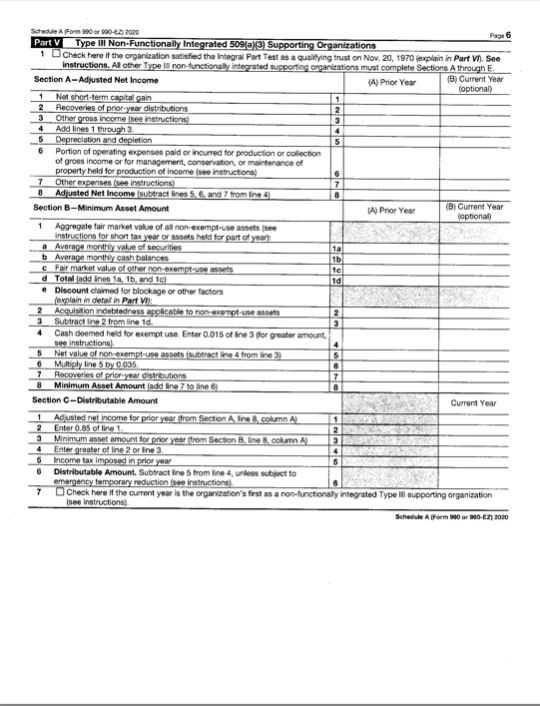

Schedule A Form 990 2022, Part VI, Type III Non-Functionally Integrated 509(a)(3) Supporting Organizations. Includes fields for adjusted net income and minimum asset amount calculations. Contains sections for prior year and current year financial details with instructions on fair market value and annual distributions. Features a 'Draft' watermark.

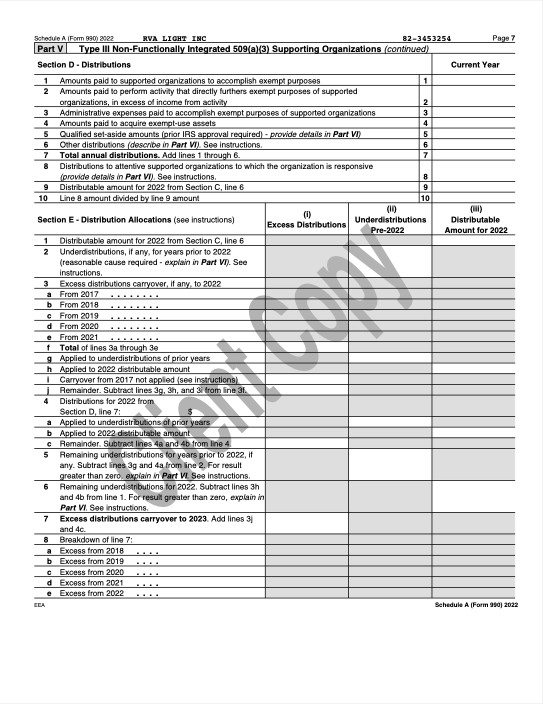

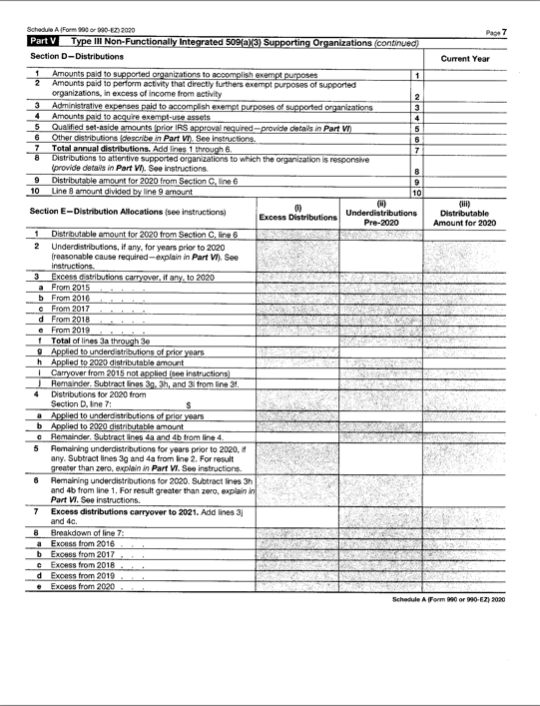

Tax form page titled 'Schedule A (Form 990) 2022' for non-functionally integrated supporting organizations, sections D and E, with tables for distributions and allocation details.

IRS Schedule A (Form 990) 2022 supplemental information page with "Client Copy" watermark and lined sections for explanations.

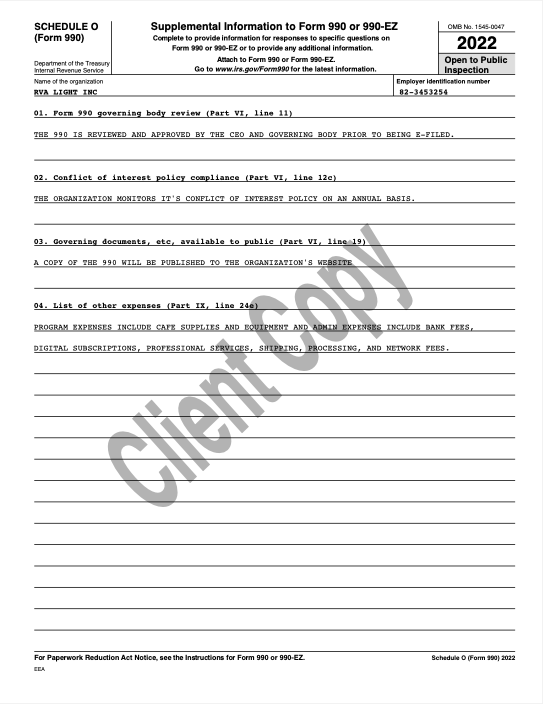

IRS Schedule O form for 2022 with sections on governing body review, conflict of interest policy, public document availability, and other expenses, labeled "Client Copy."

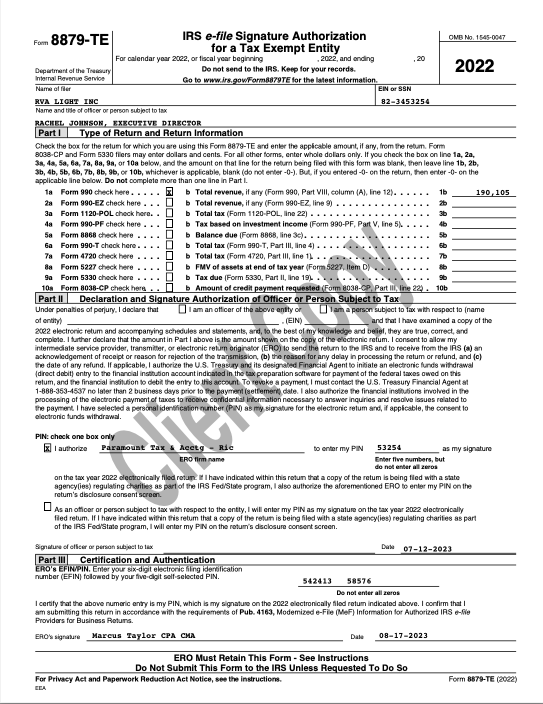

IRS Form 8879-TE for 2022, a tax e-file signature authorization for tax-exempt entities. The form includes sections for type of return, declaration and signature by an authorized officer, certification and authentication. Details include entity name, officer name, identification numbers, totals, and officer and ERO signatures with dates. Instructions clarify submission and retention requirements.

2021 Form 990

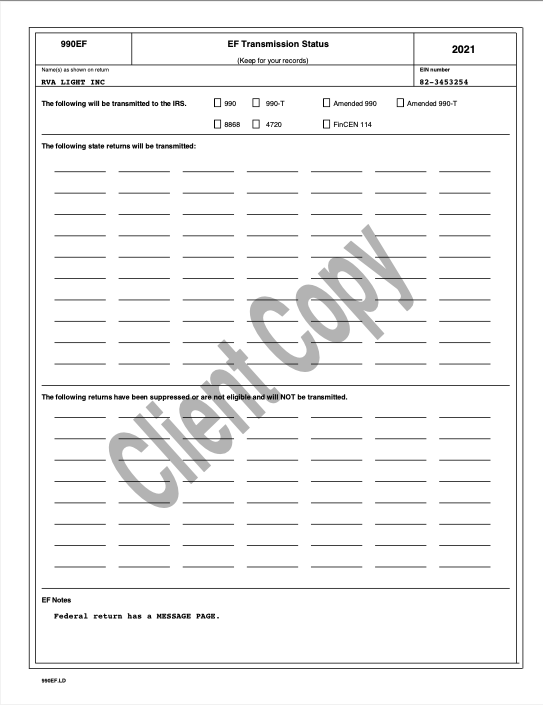

A 990EF EF Transmission Status form for 2021 with fields for IRS transmissions and state returns, marked as 'Client Copy.' It has checkboxes for various forms and sections for eligible and ineligible returns.

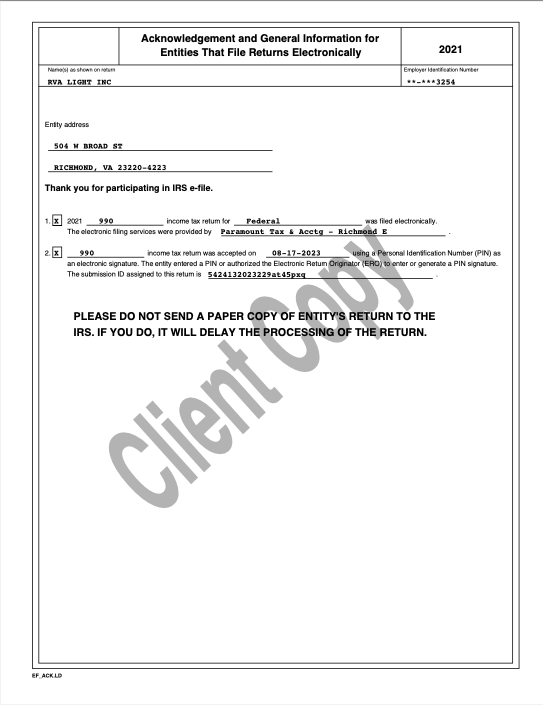

IRS acknowledgment form for electronic filing of tax return by RVA Light Inc. for 2021, with entity address in Richmond, VA. It includes details of electronic filing service and instructions not to send a paper copy to the IRS.

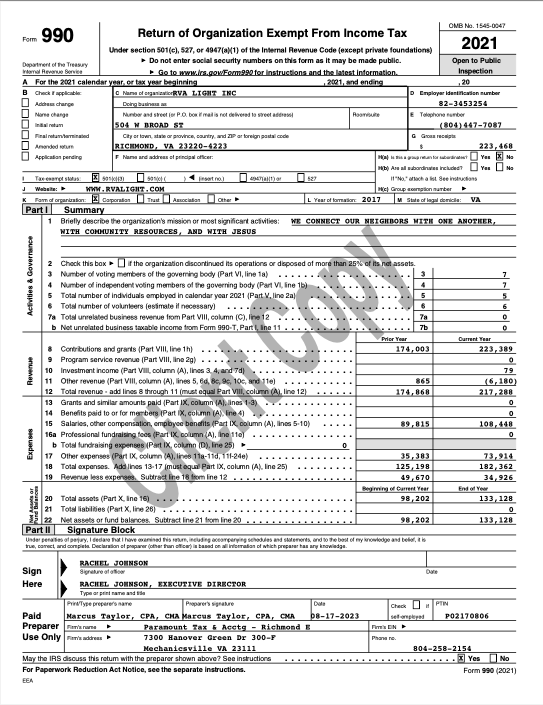

IRS Form 990 for the year 2021, used by tax-exempt organizations to report financial information. Includes organization details, financial data such as contributions, revenue, expenses, and net assets. Document labeled 'Return of Organization Exempt From Income Tax' with a watermark.

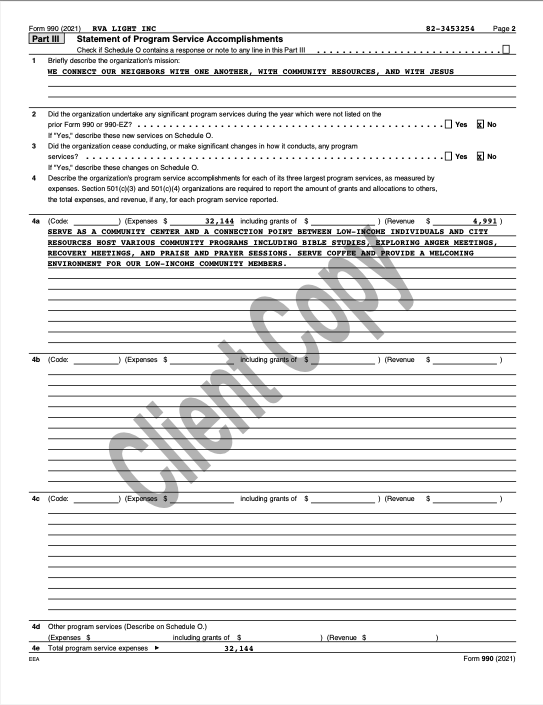

Form 990 page showing statement of program service accomplishments for RVA Light Inc. The document includes mission details, expenses, and revenue for services like community programs and support for low-income individuals.

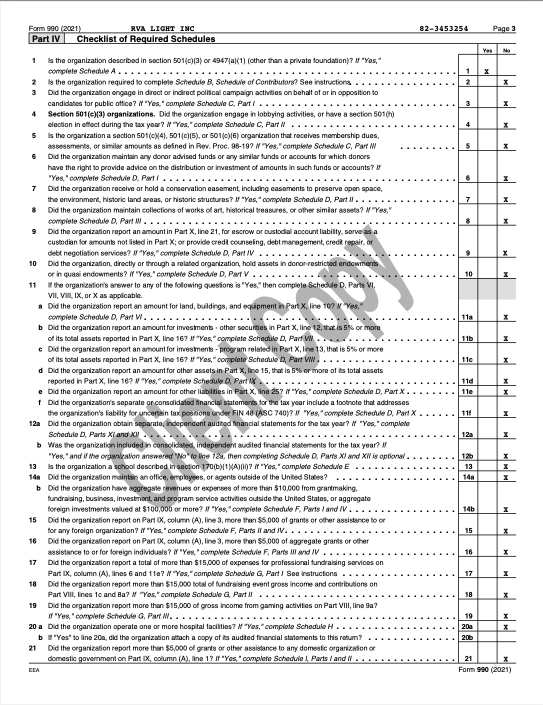

IRS Form 990 (2021) checklist page indicating required schedules for RVA Light Inc, with questions about the organization's tax-exempt status and financial activities.

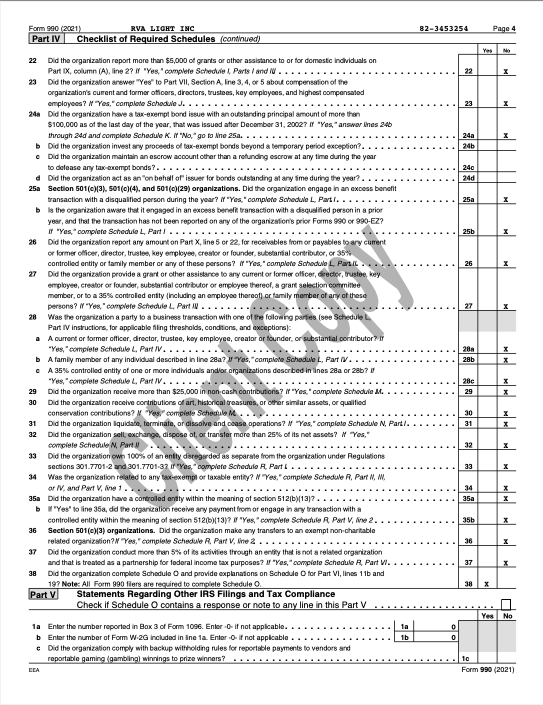

IRS Form 990 2021, page 4, checklist of required schedules for RVA Light Inc, including questions on transactions, tax compliance, and required disclosures.

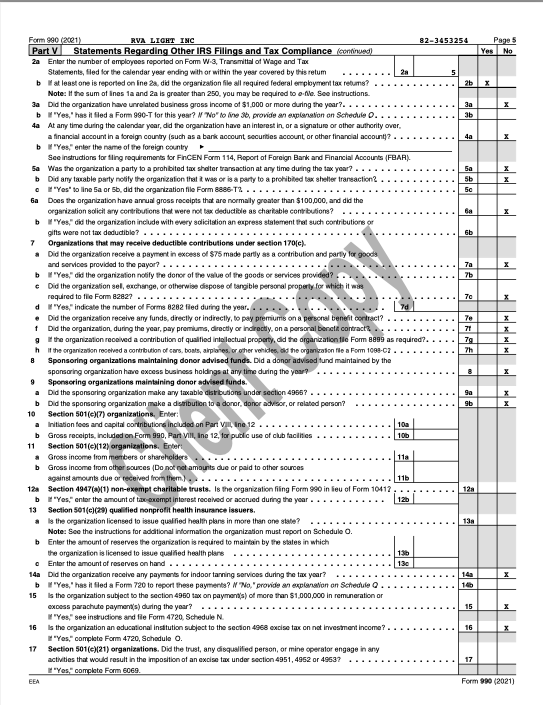

IRS Form 990, Page 5, Part V with multiple checkbox questions about tax compliance and other IRS filings, including foreign accounts, contributions, and financial statements.

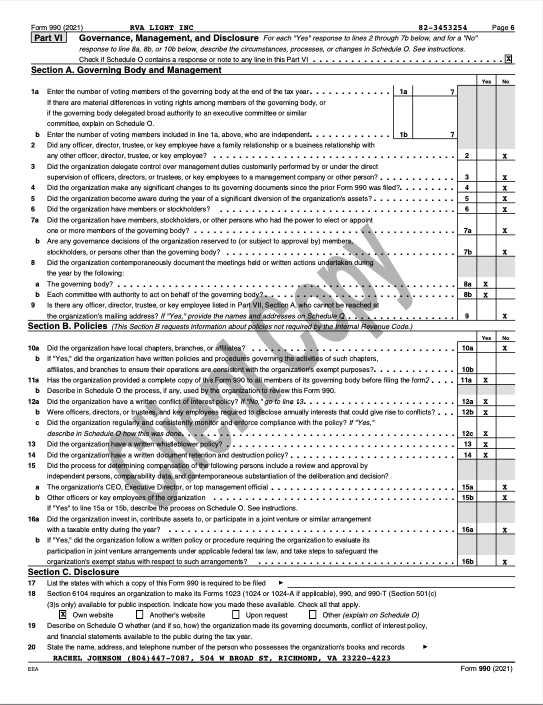

Form 990 page showing governance, management, and disclosure information for RVA Light Inc.

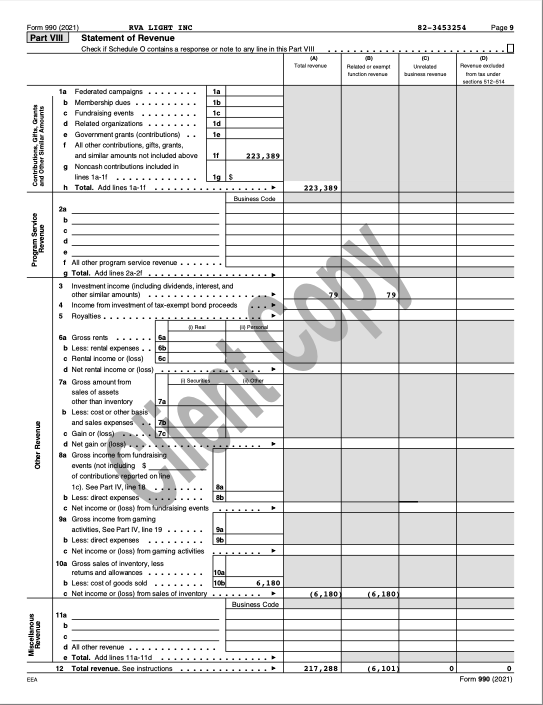

IRS Form 990 (2021), Part VIII - Statement of Revenue, with labeled sections for contributions, program service revenue, investment income, and other revenue. Total revenue amount indicated as 217,288.

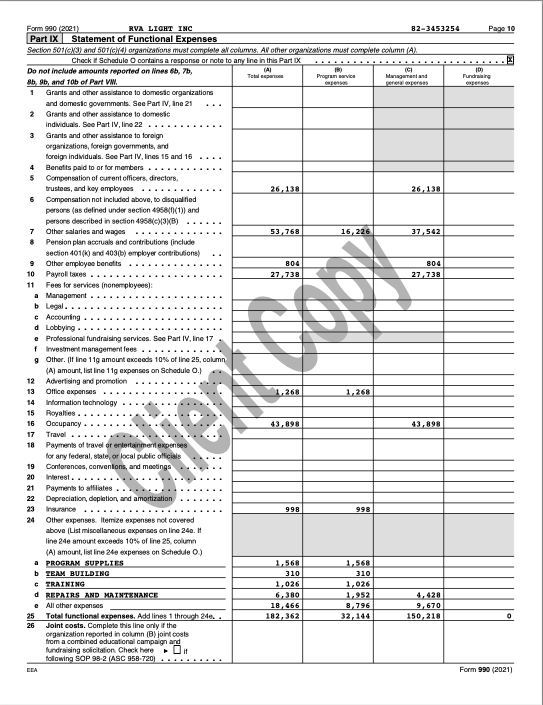

IRS Form 990 Part IX Statement of Functional Expenses, divided into columns for total, program service, management and general, and fundraising expenses, with various categories listed such as grants, salaries, benefits, and supplies. Marked "Client Copy" diagonally across the page.

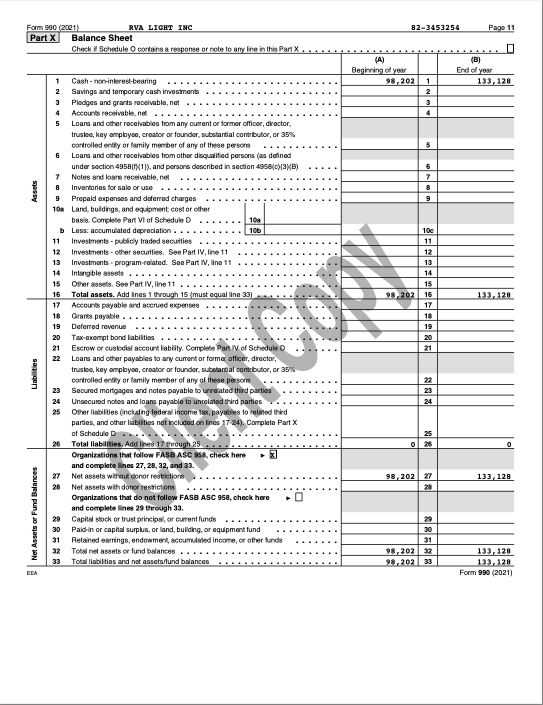

A balance sheet from Form 990 showing assets, liabilities, and net assets for an organization. It includes categories like cash, investments, liabilities, and fund balances with financial figures for the beginning and end of the year. The document is labeled as 'Sample Copy.'

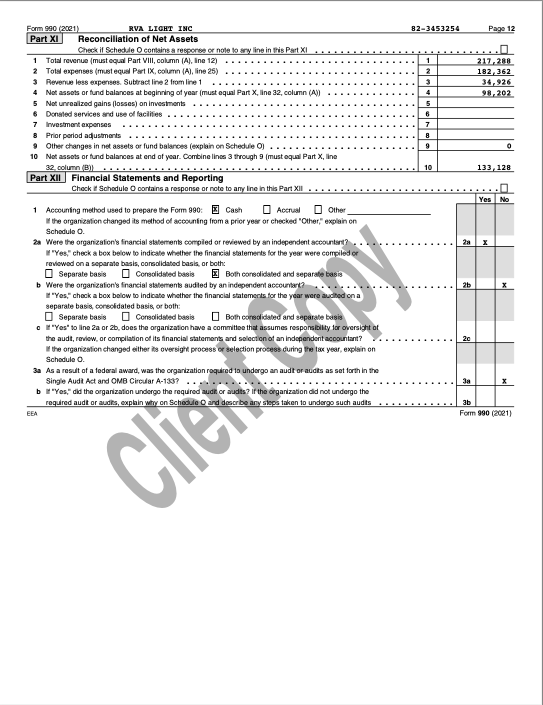

Form 990 page showing financial information and audit questions for RVA Light Inc.

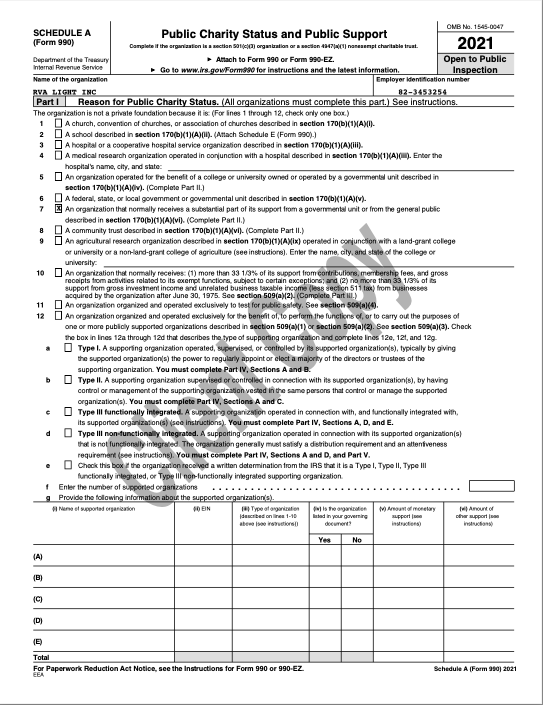

IRS Form 990 Schedule A for tax-exempt organizations, 2021, containing checkboxes and sections for public charity status and public support information.

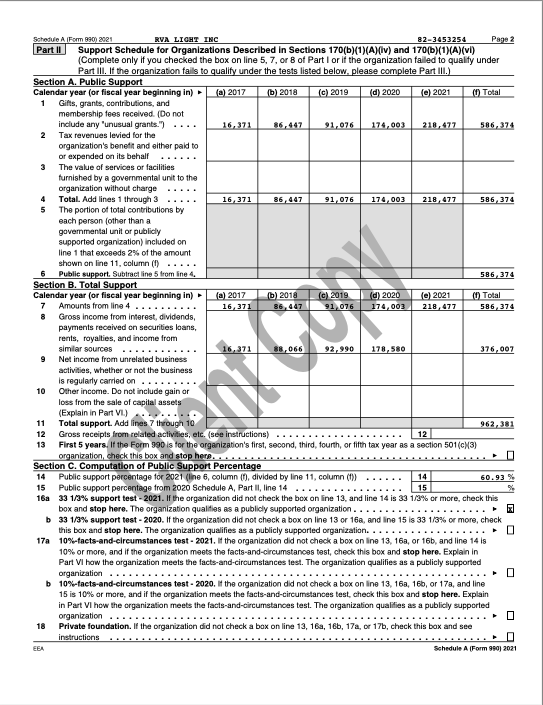

Tax form with public support schedule, includes income, donations, and financial data for years 2017-2021, labeled "Form 990 Schedule A."

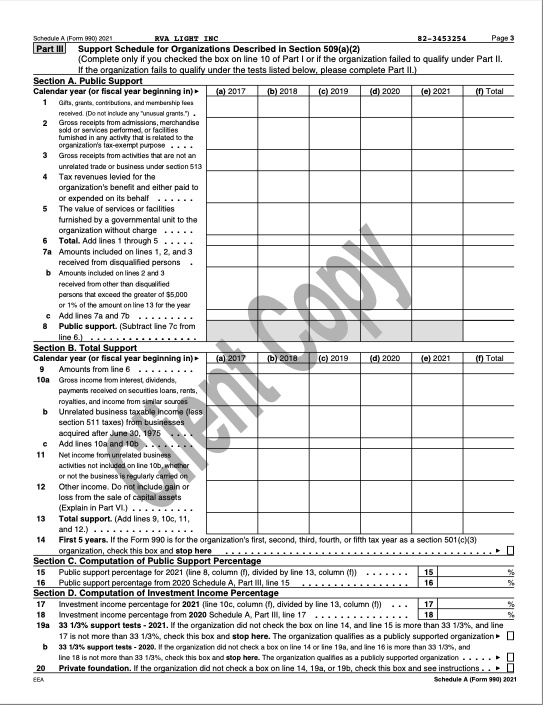

IRS Form 990 Schedule A support schedule for organizations, detailing financial data from 2017 to 2021 including public support and total support sections.

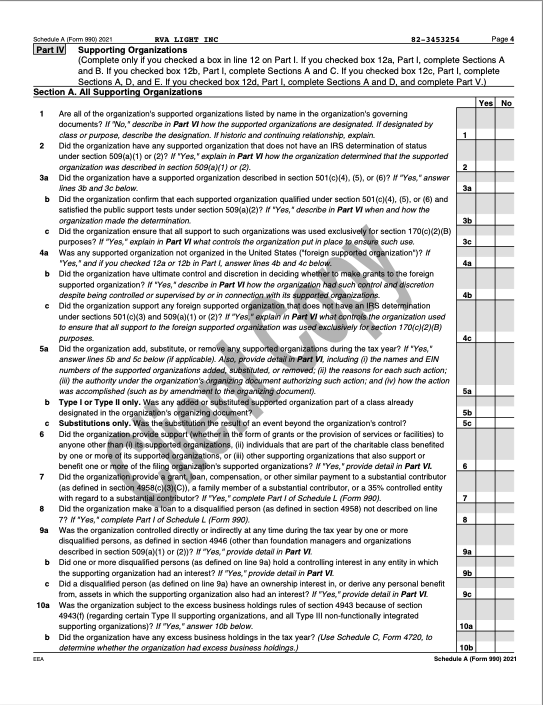

IRS Form 990 Schedule A page detailing supporting organizations, Part IV, Section A.

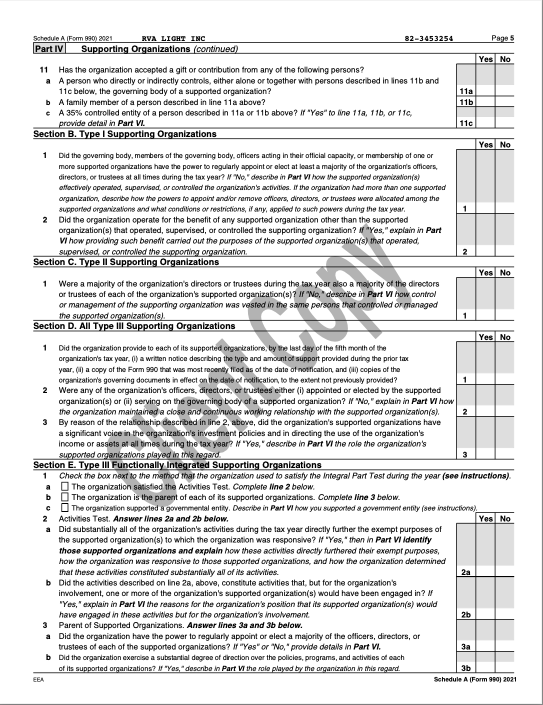

Form 990 Schedule A page focusing on supporting organizations and qualifications in sections A to E.

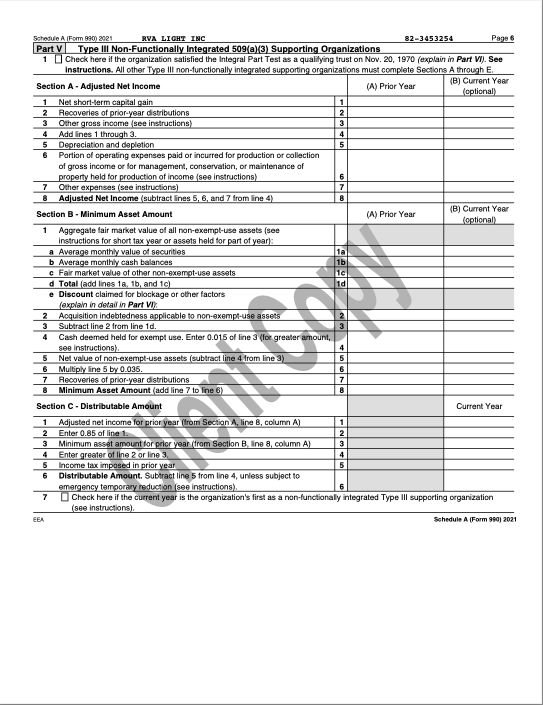

Form 990 Schedule A for 2021 showing non-functionally integrated 509(a)(3) supporting organizations and their financial details, including adjusted net income, minimum asset amount, and distributable amount.

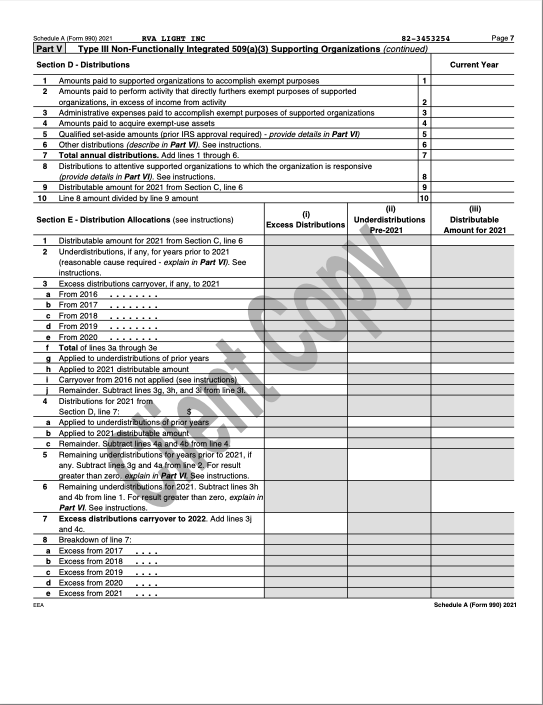

Schedule A Form 990 page for Type III Non-Functionally Integrated 509(a)(3) Supporting Organizations. Includes sections on distributions and distribution allocations with columns for excess distributions, underdistributions, and distributable amounts.

Blank tax form page with lines and watermark "Client Copy"

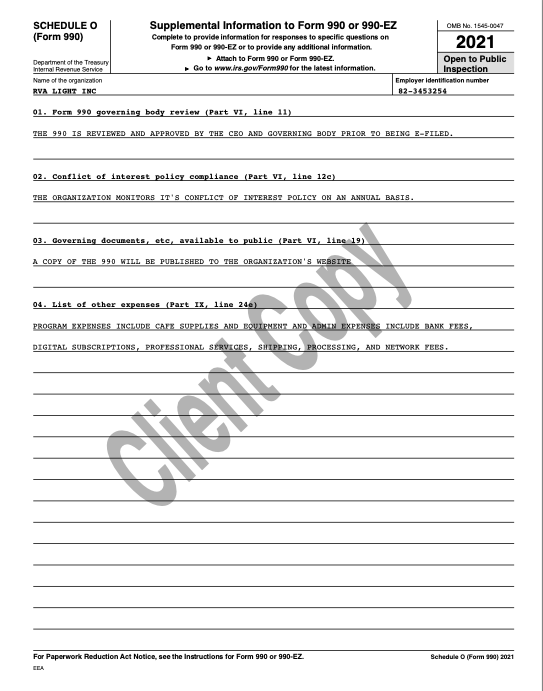

Form 990 Schedule O supplemental information for 2021, with sections on governing body review, conflict of interest policy, public documents, and expense list, marked as "Client Copy."

2020 Form 990

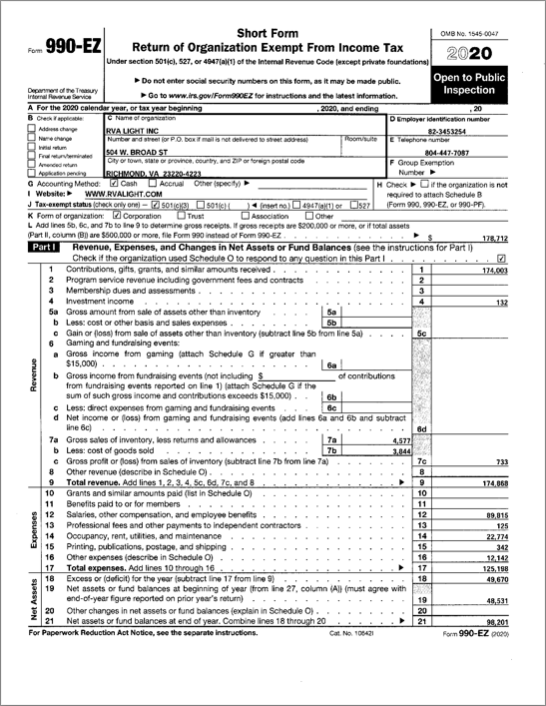

Page 2 of IRS Form 990-EZ (2020) displaying balance sheets and details of program service accomplishments. Includes expense details, program descriptions, and a list of officers, directors, trustees, and key employees with their compensation. Form lists financial data such as cash savings, assets, liabilities, and total program service expenses, filled with handwritten entries.

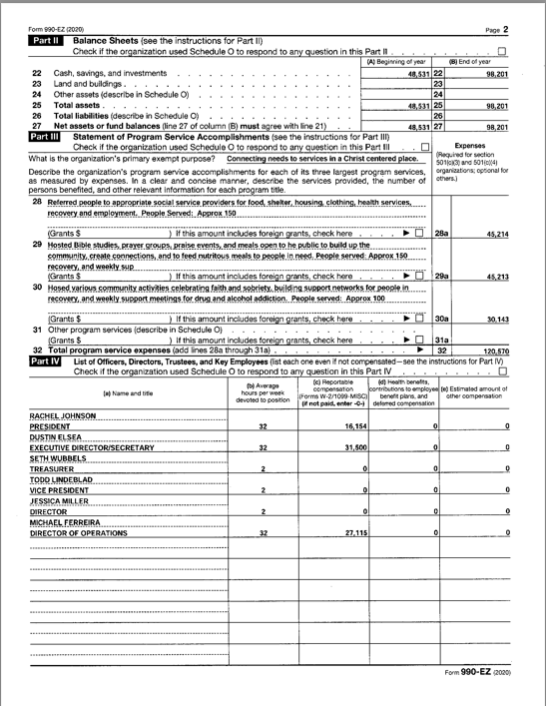

Page 3 of Form 990-EZ (2020), Part V "Other Information," containing various checkboxes and fields for reporting financial and organizational information, including political expenditures, foreign accounts, and changes in activities.

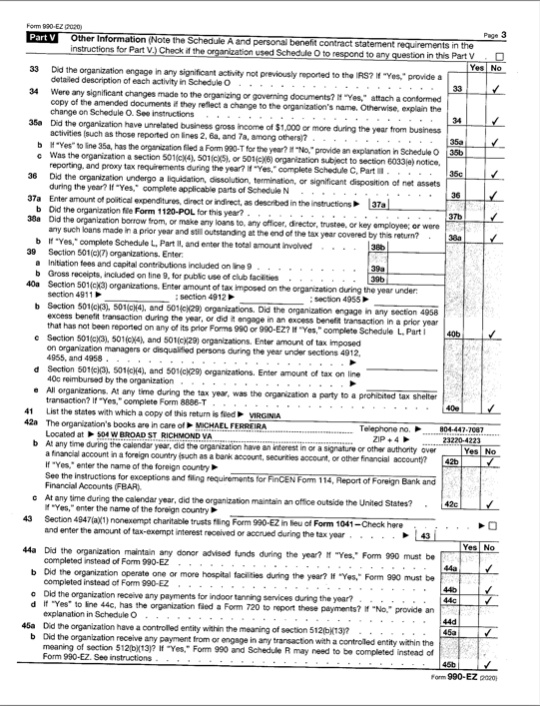

IRS Form 990-EZ Page 4, 2020 edition, featuring sections on political activities, compensation details for employees and contractors, and a signature line for the organization's president.

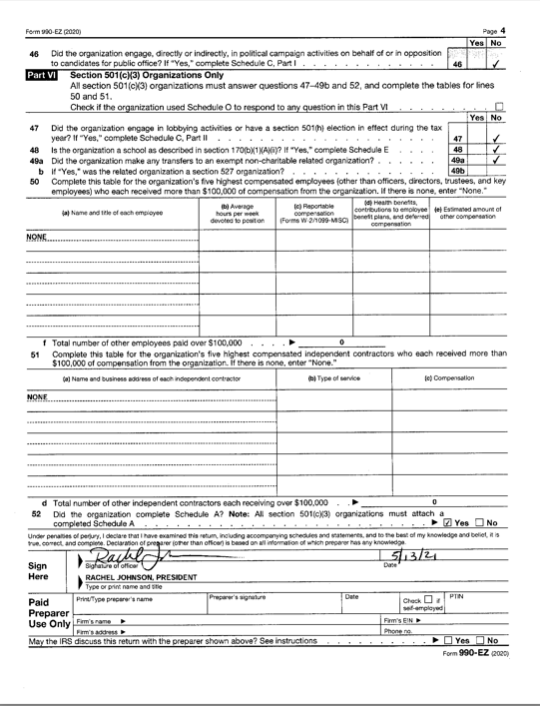

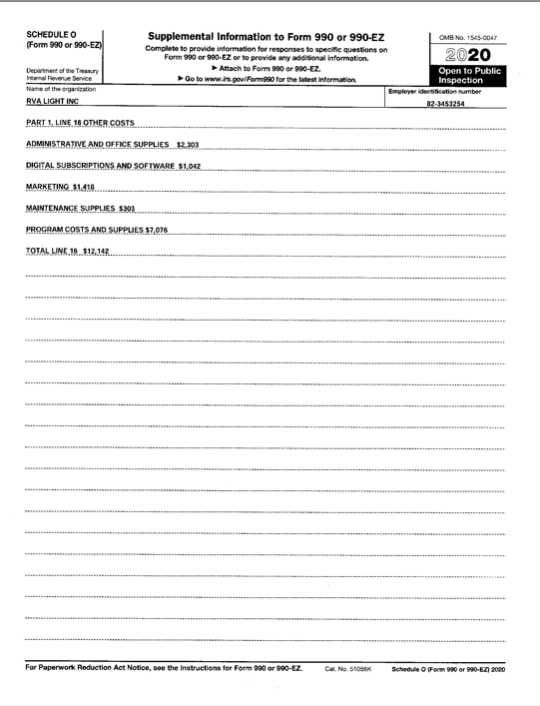

IRS Schedule O Form 990-2020, detailing organization costs: $2,303 for administrative and office supplies, $1,042 for digital subscriptions and software, $1,410 for marketing, $309 for maintenance supplies, $7,076 for program costs and supplies. Total: $12,142. For RVA Light Inc.

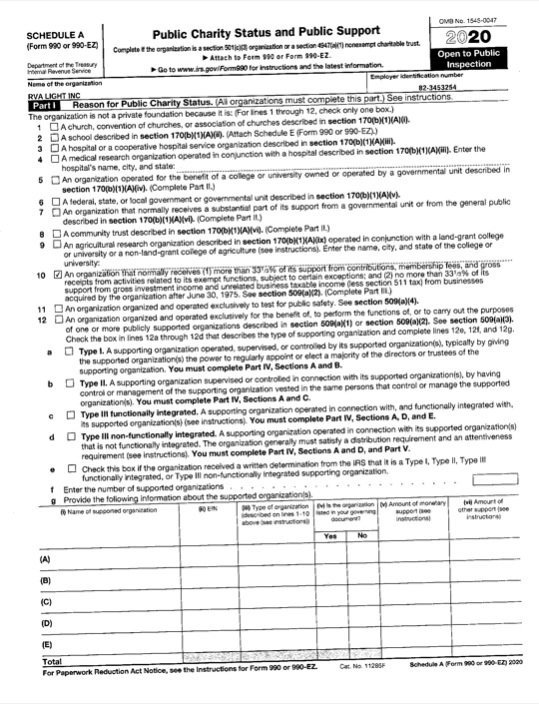

Form 990 Schedule A for public charity status, 2020

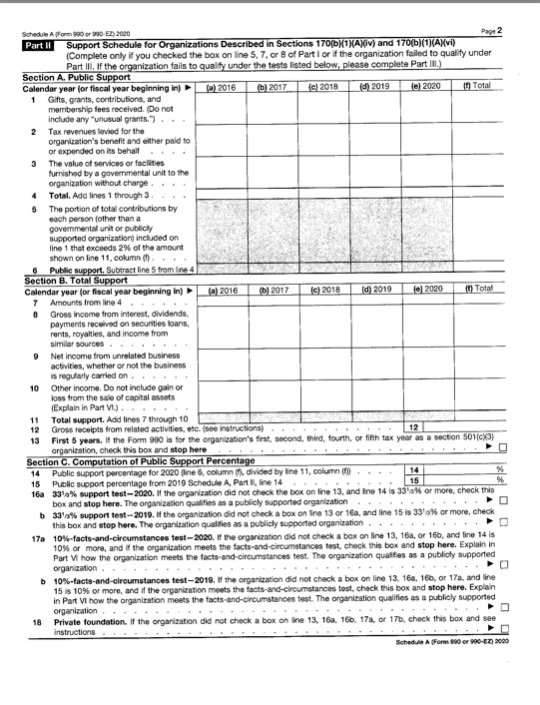

Tax form Schedule A 990-EZ support schedule for organizations, with tables for public support and total support from 2016 to 2020. Includes sections on public support, total support, and computation of public support percentage.

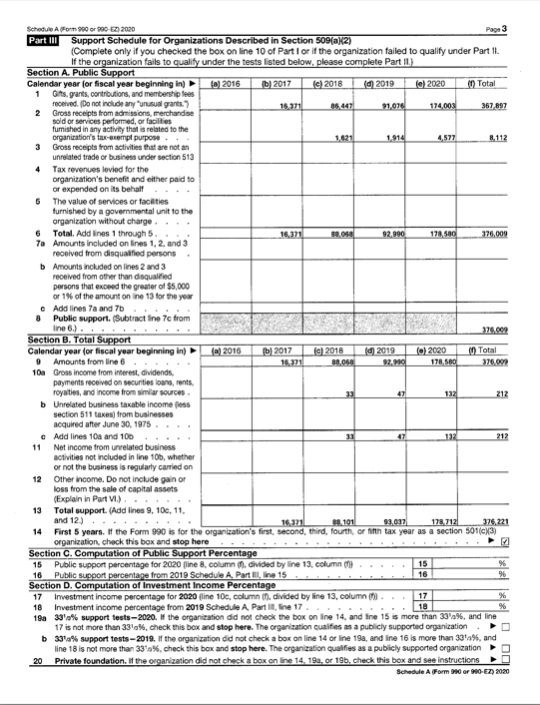

IRS Schedule A Form 990 or 990-EZ for 2020, page 3, showing parts III, IV, and V calculations for public and total support for organizations. Includes sections on public support percentage, computation of investment income percentage, and private foundation status. Contains detailed tables and guidelines for tax-exempt entities.

IRS Form 990 Schedule A for 2020, Part IV section on Supporting Organizations, with questions and checkboxes.

IRS form Schedule A 990 Part IV supporting organizations

IRS Schedule A Form 990 or 990-EZ page for Type III Non-Functionally Integrated 509(a)(3) Supporting Organizations, showing sections for adjusted net income, minimum asset amount, and distributable amount calculations.

Form 990 Schedule A page detailing distribution allocations for type III non-functionally integrated 509(a)(3) supporting organizations.

IRS Form 990 Schedule A 2020, Part VI Supplemental Information page with blank lined sections for explanations or additional information.

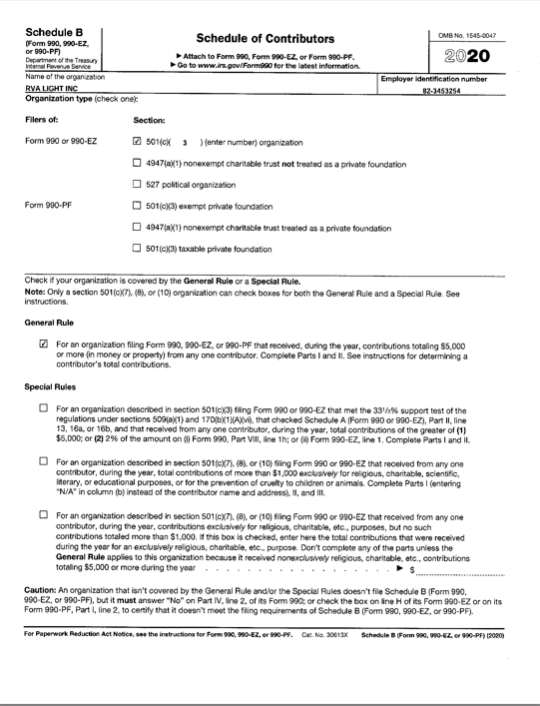

IRS Schedule B form for the year 2020, titled 'Schedule of Contributors.' Includes sections for organization type (501 forms), instructions for general and special rules, and contributor details. Used with Form 990 or 990-EZ.

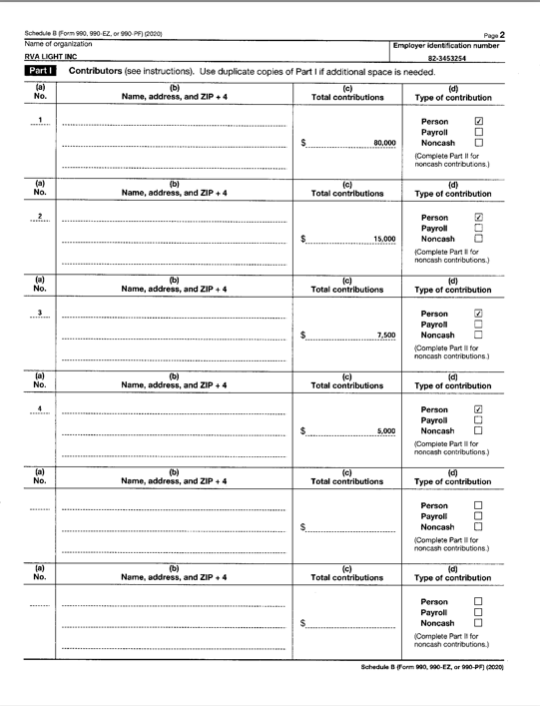

IRS Form 990 Schedule B 2006 Page 2 for RVA Light Inc, documenting contributions from individuals, including amounts of $80,000, $15,000, $7,500, and $5,000, marked as 'Person' contributions.

IRS Schedule B form page for noncash property donations, including sections for descriptions, fair market value estimates, and dates received.

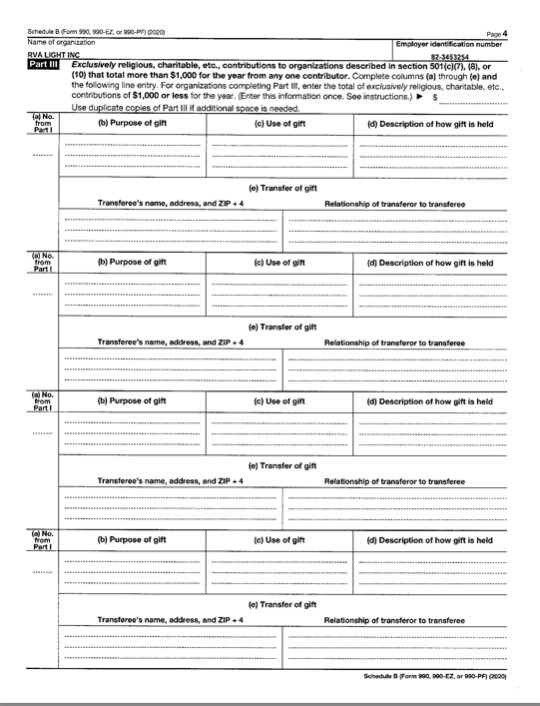

Blank IRS Schedule B form 990 for reporting charitable contributions by organizations in 2020.

Page 5 of Schedule B, IRS Form 990 for 2020, containing general instructions and information on public inspection, contributions, filing requirements, and special rules for tax-exempt organizations.

Page 6 of IRS Schedule B Form 990, 990-EZ, or 990-PF (2020) with detailed text instructions about tax reporting, contributions, and specific instructions. Includes sections on religious, charitable, and educational contributions, cash versus non-cash contributions, and filing procedures.